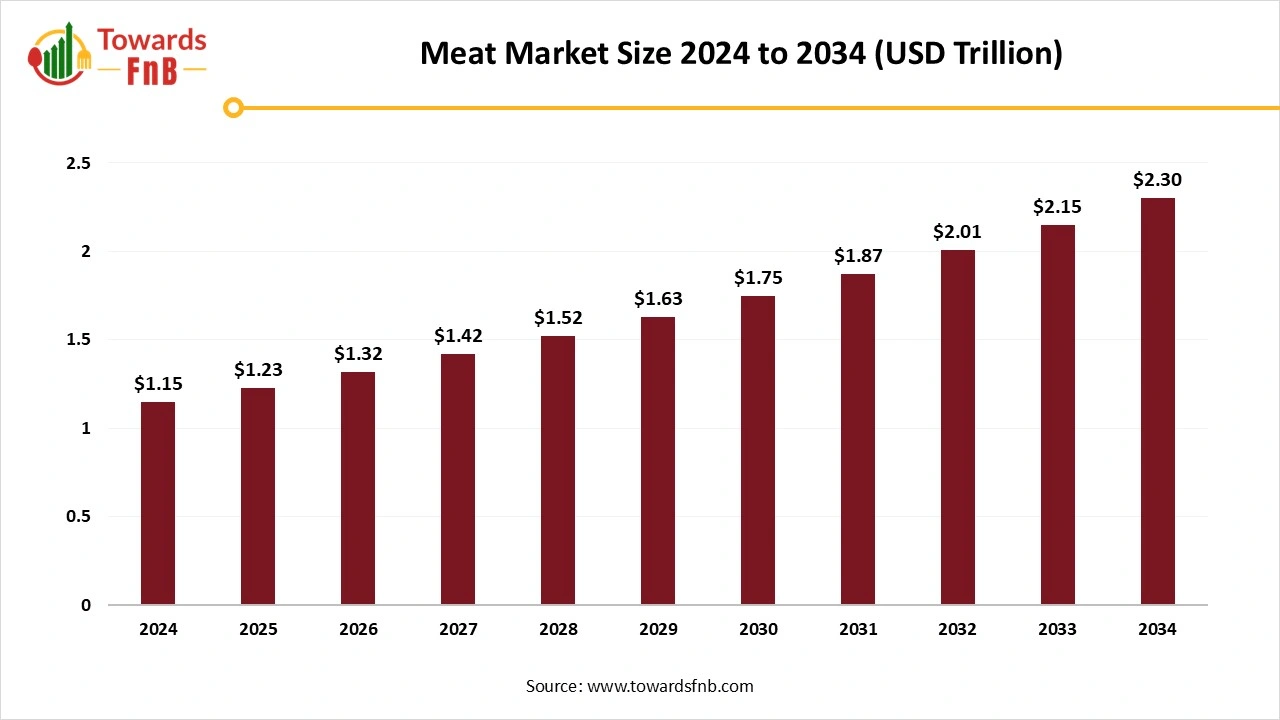

Meat Market Size Worth USD 2.30 Trillion by 2034 | Towards FnB

According to Towards FnB, the global meat market size is calculated at USD 1.23 trillion in 2025 and is expected to hit USD 2.30 trillion by 2034, reflecting at a CAGR of 7.2% from 2025 to 2034. This growth outlook reflects increasing global protein consumption, expanding cold-chain infrastructure, and a steady shift toward convenient and value-added meat products across major markets.

Ottawa, Nov. 19, 2025 (GLOBE NEWSWIRE) -- The global meat market size was valued at USD 1.15 trillion in 2024 and is predicted to increase from USD 1.23 trillion in 2025 to reach around USD 2.30 trillion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research. The study emphasizes shifting regional demand patterns, with Asia Pacific and North America expected to contribute the largest share of incremental revenues through 2034.

Higher demand for animal-based protein, rising disposable income, changing consumer preferences, and the growth of a health-conscious population are some of the major factors for the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5919

Key Highlights of the Meat Market

- By region, the Asia Pacific led the meat market in 2024, whereas North America is expected to grow in the foreseeable period.

- By type, the fresh meat segment captured the maximum market share in 2024, whereas the processed meat segment is expected to grow in the foreseeable period.

- By product, the poultry segment dominated the meat market in 2024, whereas the seafood segment is expected to grow in the foreseeable period.

- By application, the supermarkets segment dominated the meat market in 2024, whereas the independent retailers segment is expected to grow in the foreseeable period.

Global protein consumption is entering a new era where convenience, sustainability, and technology define competitive advantage,” said Vidyesh Swar, Principal Consultant at Towards FnB. “AI-driven processing, premiumization in poultry and seafood, and rising demand for blended and ethically sourced products are reshaping market opportunities across regions

Higher Demand for Convenient Food Options is helpful for the Meat Industry

The meat market is observed to grow due to rising disposable income, higher demand for animal-based protein, and changing consumer preferences. The hectic lifestyle of consumers these days leads to higher demand for convenient and ready-to-eat food options to save their time and energy. Availability of such food options in the meat variant is another major factor for the growth of the market. It helps them to maintain their protein intake and maintain their nutritional profile as well. Such options can be carried easily and can also be prepared within a few minutes to save time. Hence, it helps consumers with a time crunch to have nutritious food without wasting their time.

Rising Sustainability is helpful for the Market’s Growth

Consumer awareness regarding sustainability is followed in different domains. Maintaining sustainability helps to fuel a market’s growth seamlessly. Adapting eco-friendly practices, lowering the use of antibiotics, and strengthening the waste and emission management help to support sustainability, further fueling the growth of the market. Ethical sourcing and improved animal welfare standards also help to support the healthy initiative, which is further helpful for the market’s growth. Improved technological developments to maintain sustainability and ensure animal welfare activities also help to fuel the growth of the meat market. Use of energy-efficient processing equipment and renewable energy adoption also helps to maintain sustainability, which is helpful for the growth of the market.

New Trends in the Meat Market

- Higher demand for blended products involving traditional meat and plant-based meat for conventional eaters and vegans as well is a major factor for the growth of the market.

- Higher demand for ethically sourced meat options, grass-fed and antibiotic-free options, and organic meat are also some of the major factors for the growth of the market.

- Availability of meat options in different flavors, globally demanded on a larger scale, is another major factor driving the meat market's growth.

Recent Developments in Meat Market

- In October 2025, Abu Dhabi announced it would introduce a framework for novel food approvals. The main aim of the move is to make the region a global leader in food innovation, reduce approval timelines, and accelerate market entry for novel foods. (Source- https://www.greenqueen.com.hk)

View Full Market Intelligence@ https://www.towardsfnb.com/insights/meat-market

Impact of AI in the Meat Market

Artificial intelligence is transforming the meat market by improving production efficiency, quality control, supply chain management, and consumer engagement. In processing facilities, AI-powered robotics and computer vision systems automate tasks such as sorting, deboning, grading, and portioning with high precision. These systems detect defects, contamination, and color or marbling inconsistencies, ensuring consistent quality and reducing reliance on manual labor. Machine learning models also optimize processing speeds, equipment maintenance, and energy use, helping manufacturers lower costs and reduce downtime.

In farming and livestock management, AI-driven tools monitor animal health, feed intake, and environmental conditions through sensors, cameras, and predictive analytics. This helps farmers detect diseases early, optimize feed efficiency, improve animal welfare, and reduce veterinary costs. These insights support more sustainable production practices. AI enhances forecasting, inventory management, and cold chain logistics to reduce spoilage and ensure the timely delivery of fresh and packaged meat products. AI-enabled traceability systems help track livestock origins and production practices, supporting transparency and compliance with safety regulations.

Trade Analysis of the Global Meat Market

Import & Export Statistics

1. Global Trade Scale and Recent Trend

Global trade in meat and meat products was about 40–42 million tonnes (carcass weight equivalent) in 2023–2024, after a small decline in 2022 and a recovery in 2024. This places traded meat at roughly 10–11 percent of global meat output.

2. Top Exporters by Species (Representative Signals)

• Beef: The United States, Brazil and Australia are among the largest exporters of fresh and chilled bovine meat by value and volume, with the United States exporting several hundred thousand tonnes of boneless beef in 2023.

• Poultry: Brazil is the dominant global poultry exporter, accounting for a very large share of world chicken shipments and setting record volumes in 2023.

• Pork: Major exporters include the European Union, the United States and Brazil in selected product lines, with strong flows into Asia and the Americas. USDA and UN Comtrade proxies show notable US and EU pork shipments in 2023–2024.

3. Major Importers and Demand Shifts

China has been a major driver of recent import growth for several meat categories, with imports rising sharply since 2019 and remaining a key market for beef and poultry. Other important importers include the United States (net importer of some species and re-exporter of processed cuts), Japan, South Korea, the Philippines and several Gulf states. Recent policy reviews in China have focused on import dynamics and domestic price impacts.

4. Regional Patterns and Specialization

• Latin America is a leading export region for beef and poultry, benefiting from large herd sizes and competitive processing. Brazil in particular exported record volumes in 2023 and supplies large shares of beef and chicken to China, the Middle East and Africa.

• North America and the EU export both high-value chilled cuts and processed meat products and remain important suppliers to East Asian and Middle Eastern markets.

5. Product Forms, Logistics and Trade Modalities

Trade includes chilled and frozen carcass and cut shipments, processed and value-added meat products, and live animal trade in some regions. Frozen product shipments remain critical for long-distance trade, while chilled high-value cuts are shipped to premium markets with fast logistics and cold-chain guarantees. Tariff lines and sanitary certificates determine whether processed or fresh products are most competitive for a given route.

6. Policy, Regulation and Trade Risks

Sanitary and phytosanitary measures, import quotas, anti-dumping investigations and bilateral trade agreements significantly affect market access. Recent examples include investigations into beef import surges in China and tariff preferences or quotas that shift flows between suppliers. Chemical residues, animal disease outbreaks and traceability requirements are persistent trade-barriers that exporters must manage.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Top Products in the Meat Market

| Product Category | Description / Function | Common Forms / Variants | Key Applications / End-Use Segments | Representative Producers / Brands |

| Fresh Meat (Unprocessed) | Raw meat products sold chilled or freshly cut without curing or processing. | Whole cuts, steaks, chops, poultry cuts, ground meat | Retail, foodservice, home cooking | JBS, Tyson Foods, WH Group, Cargill |

| Processed Meat | Meat products that undergo curing, smoking, fermenting, or cooking for preservation and flavor. | Sausages, ham, bacon, deli meats, smoked meats | Retail, delis, QSR chains | Hormel Foods, Smithfield Foods, Maple Leaf Foods |

| Frozen Meat Products | Meat preserved by freezing to extend shelf life and maintain quality. | Frozen chicken, frozen beef, frozen lamb, frozen seafood | Retail, foodservice, export markets | BRF, Tyson Foods, Pilgrim’s Pride |

| Cured & Smoked Meats | Meat treated with salt, nitrates, or smoking processes for flavor and preservation. | Bacon, smoked beef, smoked poultry | Retail, gourmet foods, traditional cuisine | Hormel, WH Group, Conagra |

| Ready-to-Eat (RTE) Meat Products | Fully cooked products requiring no further preparation. | RTE sausages, meat snacks, cooked chicken strips | Convenience foods, on-the-go snacks | Conagra, Tyson Foods, Nestlé (meat snack lines) |

| Ready-to-Cook (RTC) Meat Products | Partially prepared products designed for quick home cooking. | Marinated chicken, coated meat, kebabs, meat patties | QSR, home meal kits, retail convenience | JBS, CP Foods, BRF |

| Ground Meat & Mince Products | Mechanically processed meats used in diverse culinary applications. | Beef mince, chicken mince, pork mince | Burgers, meatballs, sauces | Tyson Foods, JBS, Minerva Foods |

| Organic & Antibiotic-Free Meat | Meat produced under strict organic and antibiotic-free guidelines. | Organic chicken, organic beef, pasture-raised products | Premium retail, health-conscious consumers | Applegate, Perdue Harvestland, Organic Valley |

| Halal & Kosher Meat | Meat processed according to religious dietary laws. | Halal-certified beef/chicken, kosher beef/poultry | Middle Eastern markets, Jewish markets, global retail | Midamar, Al Islami Foods, Empire Kosher |

| Value-Added Meat Products | Enhanced meat products with added marinades, coatings, or functional ingredients. | Marinated fillets, seasoned meat, stuffed meat, breaded meat | Retail-ready meals, QSR | Kerry (seasonings), JBS, Tyson Foods |

| Canned & Shelf-Stable Meats | Long-life preserved meat products for ambient storage. | Canned chicken, corned beef, luncheon meat | Emergency rations, travel, military, and developing markets | Hormel (Spam), Libby’s, Tulip |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5919

Meat Market Dynamics

What are the Growth Drivers of Meat Market?

Higher demand for animal-based protein-rich diets is one of the major drivers for the growth of the market. Higher demand for convenient, ready-to-eat food options, sustainability, and affordability are other major factors for the growth of the market. Rapid urbanization and changing consumer preferences for different types of meat demand also help to fuel the growth of the market. Availability of different types of meat cuts on different platforms, allowing consumers to buy them easily, also helps to enhance the growth of the market. Higher demand for organic and preservative-free options also helps to fuel the market’s growth due to the growing trend of health and wellness among consumers.

Challenge

Certain Restrictions and Regulations may hamper the Growth of the Market

Issues such as consumer awareness regarding animal welfare, rising sustainability, food safety, and maintaining environmental standards are some of the major issues impacting the meat market. Certain diseases spread due to the consumption of meat products, which is another major issue observed in the growth of the market.

Opportunity

Higher Demand for Convenient Options is helpful for the Industry’s Growth

Higher demand for convenient and ready-to-eat food options is one of the major factors for the growth of the market. Such food options are highly opted for by consumers in a time crunch. They are easy to prepare and are less time-consuming. Hence, it allows consumers to munch on nutritional food options and avoid junk food. Hence, such factors help to fuel the growth of the market. Availability of meat-based snacks and ready-to-eat food options on different platforms also helps to fuel the growth of the meat market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Meat Market Regional Analysis

Asia Pacific Dominated the Meat Market in 2024

Asia Pacific dominated the meat market in 2024 due to a high population that demands poultry and seafood, improved cold chain infrastructure, rising disposable income, and higher demand for meat-based protein options. Higher demand for various meat products, such as poultry, seafood, and related products, is another major factor driving market growth. Higher demand for convenient and processed food options also helps to fuel the growth of the market. India has a major contribution in the growth of the market due to high demand for poultry and meat, improved cold chain infrastructure and logistics, and higher demand for meat-based snacks and ready-to-eat options.

North America is Observed to Grow in the Foreseen Period

Higher demand for premium-quality meat, cuts, and convenient meat options is helping fuel the market's growth in the region. Higher demand for protein-rich, clean-label, organic, and nutritious meal options is another major factor driving market growth. Higher consumption of meat-based products in quick-service restaurants, foodservice outlets, and similar establishments is another major factor driving the market’s growth. The US has a major role in market growth over the foreseeable period due to high consumer demand for premium cuts, protein-rich food options, and meat-based, convenient, and ready-to-eat options.

The Middle East and Africa Are Expected to Experience Notable Growth in the Foreseeable Period

The Middle East and Africa are expected to experience notable growth in the near future due to high demand for various meat options, including processed, fresh, and frozen. The availability of premium meat cuts, different meat varieties, and other similar factors is helpful for the market’s growth. Higher demand for poultry and seafood also helps fuel market growth. South Africa and Saudi Arabia make the highest contributions to the regional market's growth due to the high demand for red meat in these countries.

Meat Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 7.2% |

| Market Size in 2025 | USD 1.23 Trillion |

| Market Size in 2026 | USD 1.32 Trillion |

| Market Size by 2034 | USD 2.30 Trillion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Meat Market Segmental Analysis

Type Analysis

The fresh meat segment led the meat market in 2024 due to higher demand for fresh, preservative-free, and organic meat options. Higher demand for fresh meat cuts from local butcher shops, home-based kitchens, and small food service outlets further fuels market growth. Higher demand for nutritionally rich, flavorful, and meatier products with enhanced texture is another major factor driving market growth. Fresh meat cuts are readily available at local butcher shops and are highly demanded by consumers, which further supports the market's growth.

The processed meat segment is expected to grow over the foreseeable period due to high demand for convenient, ready-to-eat food options, which is a major factor driving market growth. Such options allow consumers to save time and consume nutritional options to avoid unhealthy munching. The growing demand for meat-based snacks and processed food items helps to fuel the market’s growth. Higher demand for marinated meat cuts, deli meat, sausages, and nuggets also helps to fuel the growth of the market in the foreseeable period. Foodservice restaurants and quick service restaurants require processed meat regularly, further helping the market’s growth.

Product Analysis

The poultry segment led the meat market in 2024 due to high demand for protein-rich sources that are low in fat and cholesterol. The poultry segment has higher acceptance in multiple regions, further fueling the growth of the market. Higher demand for poultry-based convenient and ready-to-cook food options is another major factor helpful for the growth of the market. Health-conscious consumers in search of protein-rich and affordable meat options prefer poultry, further fueling the growth of the market.

The seafood segment is expected to grow in the foreseeable period due to high demand for different types of seafood-based diets globally. Higher demand for meat options that are rich in protein and lower in fat also helps to fuel the growth of the market. Higher demand for omega-3 fatty acids for multiple health benefits and aiding weight loss is another major factor for the growth of the market in the foreseeable period. Higher demand for growing aquaculture, premiumization, and lean sources of protein further helps to fuel the growth of the market in the foreseeable period. Improved freezing technologies also help to fuel the growth of the market.

Application Analysis

The supermarkets segment dominated the meat market in 2024, as such stores are easily available near residential areas, allowing consumers to choose from different types of meat options. Such stores have different categories of meat and meat cuts, which are helpful for the growth of the market. Different forms of meat, such as processed, frozen, or raw, are available in such stores, which is further helpful for the growth of the market. Such stores have separate categories for different types of meat options for the convenience of consumers, further fueling the growth of the market.

The independent retailers segment is expected to grow in the foreseen period due to multiple benefits offered by the segment, such as customized meat cuts, availability of fresh meat cuts, and flexible purchasing quantities. Hence, such factors help to fuel the growth of the market. Solid customer relationships, high customization, and availability of fresh meat cuts at consumers’ doorsteps are other advantages for the growth of the market in the foreseen period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Meat Market

- JBS S.A. (Brazil) – JBS is the world’s largest meat producer, offering beef, poultry, and pork across global markets. The company operates extensive processing facilities and focuses on scaling sustainable protein production.

- Tyson Foods, Inc. (USA) – Tyson Foods is a leading supplier of beef, pork, and poultry, serving retail, foodservice, and industrial customers. The company invests heavily in automation, traceability, and alternative proteins.

- Cargill, Inc. (USA) – Cargill produces beef, turkey, and value-added meat products, supported by an integrated supply chain and global processing operations. The company emphasizes food safety, sustainability, and diversified protein offerings.

- WH Group Limited (China) – WH Group, owner of Smithfield Foods, is the world’s largest pork producer, delivering fresh pork, packaged meats, and value-added products. The company focuses on global expansion and biosecurity leadership.

- Hormel Foods Corporation (USA) – Hormel offers branded meats, prepared foods, and specialty protein products including turkey and plant-based options. The company emphasizes high-value branded portfolios and protein innovation.

- Marfrig Global Foods S.A. (Brazil) – Marfrig is a major beef producer with strong export operations supplying North America, Asia, and Europe. The company prioritizes sustainable beef programs and supply-chain transparency.

- Charoen Pokphand Foods Public Company Limited (CP Foods) (Thailand) – CP Foods produces poultry, pork, and ready-to-eat meals through an integrated agro-industrial supply chain. The company focuses on international expansion and animal welfare standards.

- Danish Crown A/S (Denmark) – Danish Crown is Europe’s leading pork exporter, offering pork, beef, and processed meat products. The company emphasizes climate-neutral production and high-quality European standards.

- Beyond Meat (USA) – Beyond Meat produces plant-based meat alternatives designed to mimic beef, poultry, and pork. The company focuses on clean-label formulations and global retail and foodservice growth.

- Impossible Foods, Inc. (USA) – Impossible Foods develops plant-based meat products using its signature heme-based technology to replicate meat flavor and texture. The company targets sustainability-driven consumers and large-scale foodservice partnerships.

Segment Covered in the Report

By Type

- Fresh Meat

- Processed Meat

By Product

- Pork

- Poultry

- Sea Food

- Lamb & Goat

By Application

- Super Market

- Convenience Store

- Independent Retailers

- Other

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5919

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.